Accountancy & Taxation Services

Management Accounts

Management accounts are a crucial source of information for a business when making informed decisions and maintaining financial control.

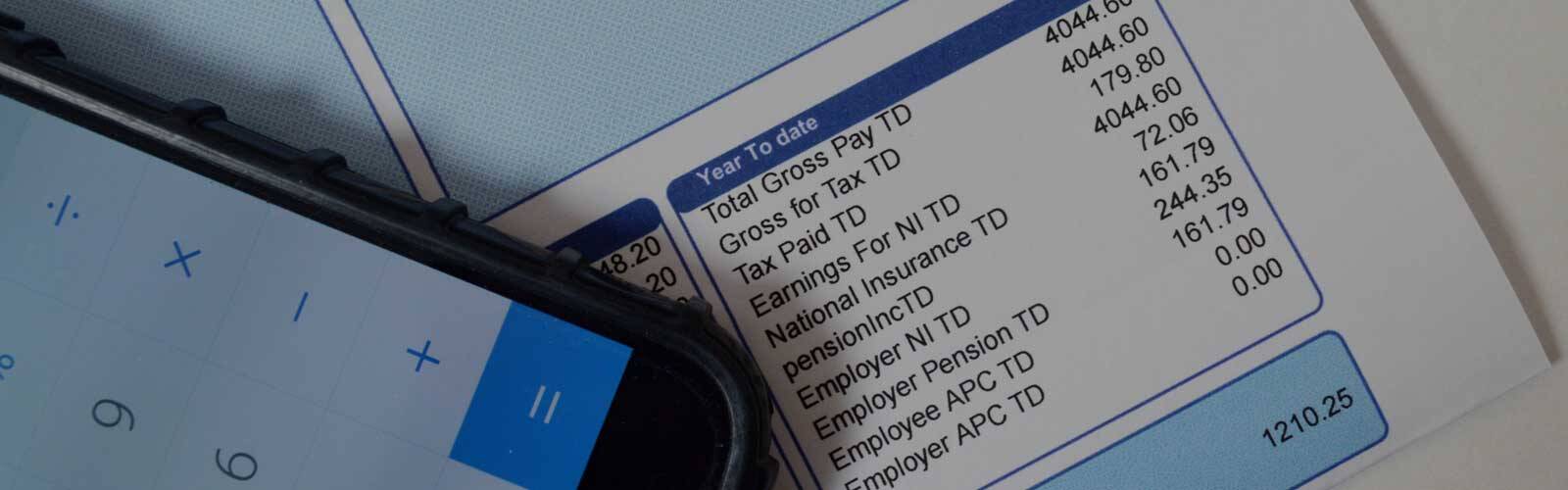

Corporation Tax

Corporation tax is a tax paid by companies on their profits, including those from all sources of income (other than dividends from UK companies) and chargeable gains.

Bookkeeping

Bookkeeping involves the daily recording and categorisation of a business’s financial transactions, while analysing and reporting them to monitor the financial performance of the business.

VAT Returns

Our team can help to ensure that your business maintains compliance with regulations by submitting returns on time, thereby avoiding overpayments and penalties.

-

Get ready for Making Tax Digital for Income Tax

If you’re one of the (un)lucky individuals who need to join Making Tax Digital for Income Tax (MTD IT) from 6 April 2026, you probably know that this involves submitting regular, digital records to HMRC. But what do you need to do to prepare?

-

Homeworking: claiming input tax on subsistence expenses?

Some of your staff work remotely, but their homes aren’t suited to it. You have agreed to pay for rented office space, or for refreshments if they work from, say, a café. Can you claim input tax on these expenses?

-

Beating the landlord tax hikes

Once again, landlords will be hit by tax increases announced in the Budget, even if they are operating through a company. What are the changes, and can anything be done to mitigate them?

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.